Journal Entry For Personal Use Of Company Car

Essentially personal use of a company car is treated as a taxable fringe benefit subject to income tax withholding obligations by the employer. Credit cash for the amount paid.

Solved Journal Entries For Fixed Asset Sale Vehicle With

This can be done each pay period monthly annually or whenever you choose.

Journal entry for personal use of company car. When a company car is used for personal use that use becomes non deductible for business purposes. You mentioned that the car is used 12 Personal a further entry is necessary to reflect this and will depend on your business structure. Purchasing a car paid by cheque Car ac dr To Bank ac Car is a real ac and asset comes in so debited Bank is a personal ac and bank is giver.

Would someone be able to help me with the following question for my assignment. Because your car has both personal and business use you must keep detailed records of all expenses incurred and the. Purchase of Car Journal Entry.

However you must be able to show that the expenses were incurred for the purpose of earning business income and were reasonable in the circumstances. For personal use types of equipment furniture computers etc if it is used less than 50 for business you cannot claim an ITC. If you use a company car for your personal use that use might be considered taxable income.

If you put a down payment on the vehicle then the journal entry is. Trips unrelated to your organizations purpose work trade etc. If you are a small-business owner and buy a pickup truck.

Use on a vacation or on the weekend. If for example an owner pays business travel expenses of 150 using a personal credit card then the amount would be debited to the travel expense account. If this is not what you mean then please rephrase your question with greater clarity.

Debit Decrease GST payable balance sheet. The value and personal use of demonstrator cars by persons meeting the definition of a full-time automobile salesperson may be excludable if certain restrictions on personal use are in force. Hi carolcurrier101 let me offer some insight.

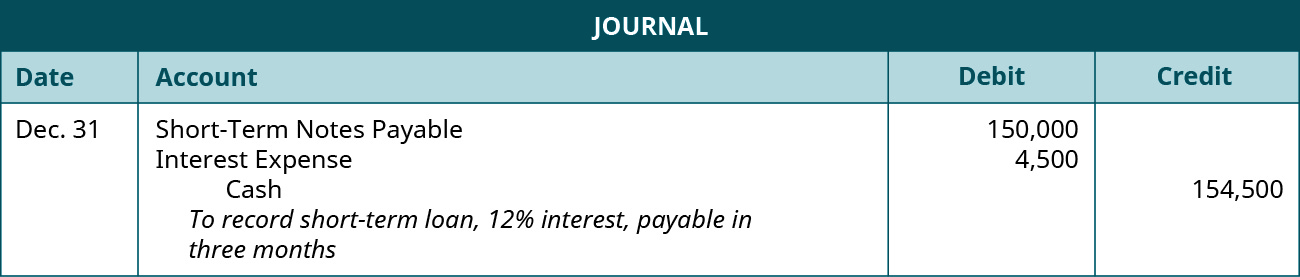

I calculate the 10 as 133289. When a business owner has goods withdrawn for personal use they are recorded on the drawings account. When interest is paid you journalize the entry as follows.

In accounting assets such as Cash or Goods which are withdrawn from a business by the owners for their personal use are termed as drawings. Use by someone other than an employee of your company. The car is still yours.

Driving a company vehicle for personal use is a taxable noncash fringe benefit aka benefit you provide in addition to wages. I like to do monthly journal entries for Depreciation though most. The question is to take 10 of the quarterly telephone ac from the PL and do a general journal to account for private use.

Accumulated Depreciation 1000000. So we need to make accounting entries for 10000 each year. If youre just using a personal car for business purposes there is no journal entry for you to make.

For example if a business owner has goods withdrawn for personal use which cost 600 then the amount must be recorded on the owners drawings account and not as an expense for the business. Depreciation Expense 1000000. Business use of a company car is.

Dr EquityDrawings 243 Cr Depreciation - Holden Personal Expense Account 243. Infrequent personal usage of company vehicles is typically deducted from an employees salary. If a Sole Trader.

Your employees commute between home and work if its on a regular basis. The imputed value per Pub 15-B is 13250 so we need to include in his salary 10600 of fringe benefit income and collect the corresponding. Assuming no tax is involved in the purchase of the inventory by the business then the.

Title has not changed hands. If you use a flat mileage deduction rather than actual expenses it becomes relatively easy to calculate percentage of miles driven personal vs business but even that calculation can be used against actual vehicle expense to reduce what the. As a sole proprietor you may claim car expenses related to your business.

It is also called a withdrawal accountIt reduces the total capital invested by the proprietors. Vehicles are usually afforded a five year life. But the benefit to the employee isnt completely free under current tax law.

Fuel is not reimbursable on company vehicle where the calculation for business expense is based on IRS formula and personal portion of mileage must be added to W-2 as taxable income. If the employee uses the company car strictly for business purposes treat the usage differently. As a result you generally must include the value of using the vehicle for personal reasons in the employees income and withhold taxes.

Personal use of a company vehicle includes. Journal Entry for Using Personal Credit Card For Business. The accounting records will show the following bookkeeping entries when a personal credit card is used for business.

If this is a vehicle purchase you may have to capitalize the GST as there are special rules on how to claim your ITCs. Debit vehicle for the cost. Lake Kelsey check out these two chats on whether your company should own the vehicle and how to reimburse for use of your personal vehicle if you are incorporated.

Because of this the employer should report the value of the employees personal use of the vehicle in the employees wages included in box 1 on Form W-2. Personal use of the company-provided vehicle is considered to be a fringe benefit for the employee a form of non-cash compensation. If a Company the journal is Dr Directors Loan 243 Cr MV Contribution Income Account 243.

Private use general journal entry. This is subject to all Federal and State taxes but you are only required to withhold Social. If an employee or owner drives a company vehicle for personal use including commuting back and forth to work you must include the value of the personal use in their income.

In the case of goods withdrawn by owners for personal use purchases are reduced and ultimately the owners capital is adjusted. Free use of a company car is one of the best perks an employee may be entitled to as part of a compensation package. With the vehicle loan the money is usually paid directly to the car sales company so the business doesnt handle the money.

The accounting entries for the first year would be as follows. Use of personal vehicle requires tracking miles and can be reimbursed at IRS mileage rate. Answer 1 of 4.

To accomplish this we need to make an entry to account for depreciation. In addition when qualified employees are allowed to use company vehicles for commuting due to unsafe conditions the value of commuting mileage can. These car journal entries are for a vehicle costing 15000 and for a loan of 5 years at 12 with fortnightly payments calculated using the same Loan Amortization template mentioned above.

The amount from the PL is 133289. Credit the note payable for face amoun of the note. Take the time to visit CRAs website and get to know the tax rules surrounding vehicles it can be complicated as it is easy pickings in an audit for those that dont follow the rules or werent.

In this case Im trying to properly comply with the personal use vehicle fringe benefit. The case in question is an owner-employee of an S Corp with a 20 business use vehicle purchasedowned by S Corp.

Insurance Journal Entry For Different Types Of Insurance

Journal Entries Examples Format How To Explanation

Disposition Of Depreciable Assets

Accounting Journal Entries Examples

Prepare Journal Entries To Record Short Term Notes Payable Principles Of Accounting Volume 1 Financial Accounting

Payroll Journal Entries For Wages Accountingcoach

Journal Entries Examples Format How To Explanation

Personal Expenses And Drawings Double Entry Bookkeeping

What Is The Journal Entry For The Cash Withdrawn By The Proprietor For Personal Use Quora

Accounting Basics Purchase Of Assets Accountingcoach

Accounting Basics Purchase Of Assets Accountingcoach

Insurance Journal Entry For Different Types Of Insurance

Insurance Journal Entry For Different Types Of Insurance

Buy Equipment With Down Payment In Cash Double Entry Bookkeeping

Rent Deposit Accounting Journal Entry Double Entry Bookkeeping

How Do I Remove A Fixed Asset An Old Vehicle That

Goods Withdrawn For Personal Use Double Entry Bookkeeping

Accounting Journal Entries Examples

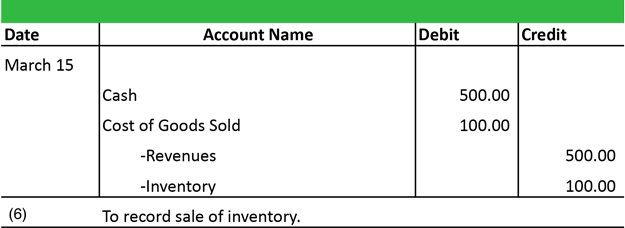

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

Post a Comment for "Journal Entry For Personal Use Of Company Car"